BlackRock’s IBIT ETF Hits 500,000 BTC Milestone

In a remarkable feat, BlackRock’s iShares Bitcoin Trust (IBIT) has hit a major milestone—amassing over 500,000 Bitcoin (BTC). With a valuation of approximately $48 billion, this achievement showcases the growing influence of institutional investments in the cryptocurrency world. But what does this mean for the crypto market, and why does it matter? Let’s break it down.

A Milestone Worth Celebrating

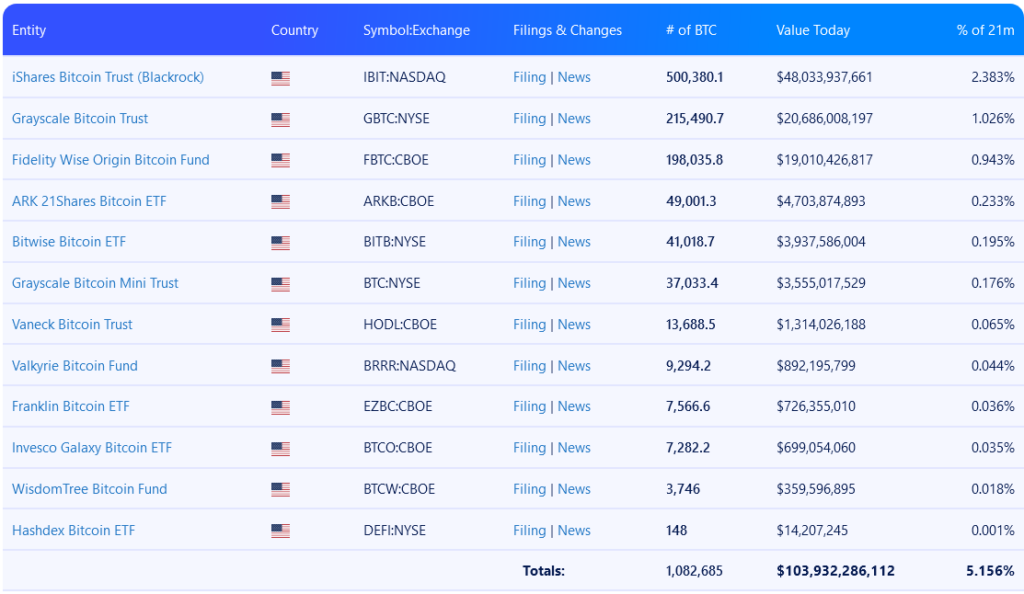

As of December 2, 2024, IBIT holds 500,380 BTC, accounting for about 2.38% of Bitcoin’s total supply. This milestone comes less than a year after the ETF launched on January 11, 2024. To put this into perspective, IBIT has rapidly gained traction and secured a commanding position in the evolving cryptocurrency landscape.

Key Numbers That Matter

- Market Influence: IBIT’s Bitcoin holdings represent a significant chunk of the crypto market, underscoring its influence on Bitcoin’s price and liquidity.

- Institutional Ownership: Ownership levels have reached 24% among institutions as of Q3 2024, solidifying BlackRock’s foothold in the ETF space.

- Surging Inflows: In November alone, IBIT attracted $6.6 billion in net inflows, riding the wave of Bitcoin’s price climbing to around $96,000.

Why This Matters for the Market

IBIT is more than just another ETF, it’s a symbol of how far cryptocurrencies have come in gaining mainstream acceptance.

IBIT vs. MicroStrategy

BlackRock has outpaced one of the biggest Bitcoin holders, MicroStrategy, which currently holds 402,100 BTC. This development emphasizes the rising dominance of ETFs as preferred vehicles for institutional crypto investment.

Setting a New Standard

IBIT isn’t just any ETF—it’s among the top three ETF launches of 2024, surpassing even traditional heavyweights like the iShares Gold ETF (IAU). This indicates a shift in investment trends, where digital assets are now seen as viable alternatives to traditional stores of value like gold.

A Trend Toward Institutional Crypto Adoption

The rapid success of IBIT mirrors a broader movement: institutional adoption of cryptocurrencies.

Spot Bitcoin ETFs: The Game Changer

Spot Bitcoin ETFs like IBIT have revolutionized how institutions approach cryptocurrency investments. By offering simplified access and eliminating challenges like custody, these ETFs are drawing in billions.

- Cumulative inflows into Bitcoin ETFs now stand at $31.2 billion, edging closer to Satoshi Nakamoto’s estimated 1.1 million BTC holdings.

- Analysts predict spot Bitcoin ETFs will continue to dominate as portfolio diversifiers, reshaping traditional investment strategies.

A Ripple Effect Across the Market

The success of IBIT and similar ETFs is sparking interest across sectors:

- Pension Funds and Hedge Funds: These institutional players are increasingly integrating Bitcoin ETFs into their portfolios.

- Retail Investors: ETFs are making cryptocurrency more accessible for individual investors looking for exposure without managing complex wallets or keys.

Looking Ahead: What’s Next for IBIT and Bitcoin?

Experts believe that IBIT could hold nearly 1 million BTC in the coming years if the current adoption rates continue. This level of growth not only cements BlackRock’s role as a leader in crypto investment but also speaks volumes about Bitcoin’s future as an asset class.

Projections for Bitcoin’s Price

With institutional demand surging, Bitcoin’s price is expected to climb further. Many believe that crossing the $100,000 mark is not a matter of if, but when.

ETFs as Catalysts for Adoption

Bitcoin ETFs are doing more than just attracting investors—they’re making cryptocurrency mainstream. By reducing operational hurdles like storage and taxes, ETFs are paving the way for widespread adoption of digital assets.

Why Bitcoin ETFs Are Here to Stay

The introduction of ETFs like IBIT is transforming the way we think about cryptocurrencies:

- Simplified Investment: No need for technical knowledge or direct custody of assets.

- Mainstream Appeal: ETFs provide a bridge between traditional finance and the crypto world.

- Institutional Confidence: BlackRock’s success shows that even the most traditional investors are ready to embrace Bitcoin.

What This Means for You

Whether you’re a seasoned investor or a curious observer, the rise of IBIT is a signal to pay attention. Bitcoin is no longer just a niche asset—it’s becoming a cornerstone of modern investment portfolios.

Key Takeaways

- BlackRock’s IBIT has proven that institutional adoption of Bitcoin is real and growing fast.

- ETFs like IBIT are making cryptocurrencies more accessible to the masses.

- The success of these products could push Bitcoin to new price heights, breaking barriers in both perception and valuation.

Final Thoughts

BlackRock’s IBIT isn’t just an investment product; it’s a representation of the changing tides in global finance. As institutional and retail investors alike pour billions into Bitcoin ETFs, the future of cryptocurrency looks brighter than ever.

Whether you’re investing or simply observing, one thing is clear: cryptocurrencies are here to stay, and they’re reshaping the financial world as we know it.

What are your thoughts on this milestone?

Source:

- BlackRock’s Bitcoin ETF Becomes Most Successful ETF Ever After $50B Milestone

- BlackRock’s Bitcoin ETF Surpasses 500,000 Bitcoin

- BlackRock’s IBIT Reaches 500,000 BTC Milestone; Grayscale Files for Solana ETF